IRS Instruction 1040 Line 20a & 20b 2014-2025 free printable template

Show details

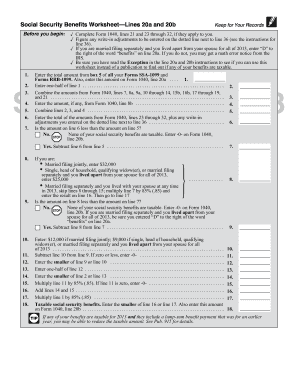

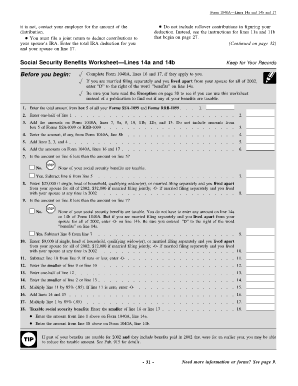

2014 Form 1040 Lines 20a and 20b Social Security Benefits Worksheet Lines 20a and 20b Before you begin: 1. 2. 3. 4. 5. 6. 7. Keep for Your Records Complete Form 1040, lines 21 and 23 through 32, if

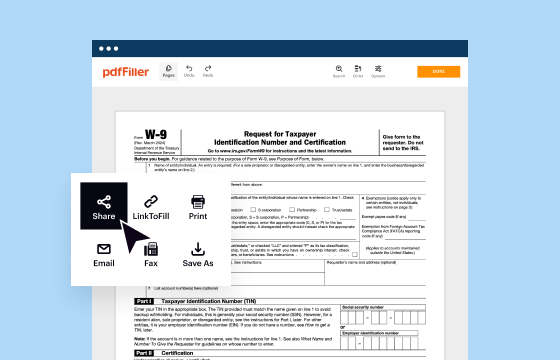

pdfFiller is not affiliated with IRS

Understanding and Effectively Utilizing IRS Instruction 1040 Line 20a & 20b

Step-by-Step Directions for Inputting Information

Detailed Instructions for Completing the Form

Understanding and Effectively Utilizing IRS Instruction 1040 Line 20a & 20b

IRS Instruction 1040 Line 20a & 20b provides vital information for taxpayers regarding tax credits related to foreign income and adjusted gross income (AGI). This guidance is crucial for ensuring accurate reporting, maximizing potential credits, and maintaining compliance with federal tax obligations.

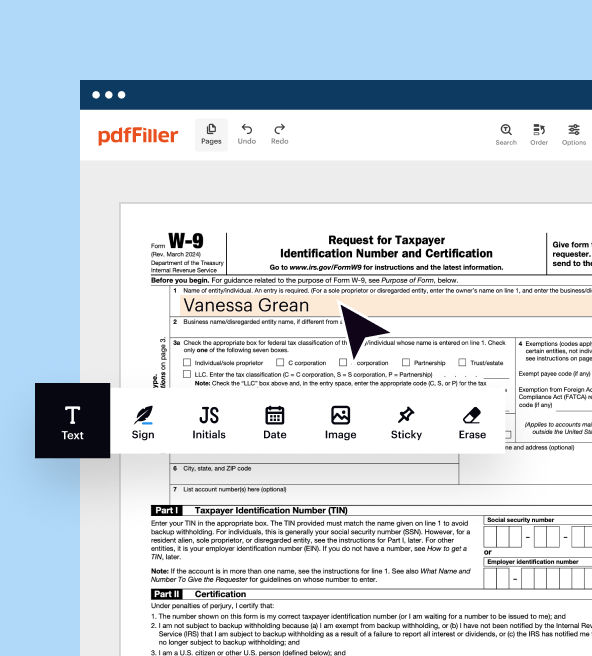

Step-by-Step Directions for Inputting Information

01

Gather necessary documentation, including Forms W-2 and 1099, showcasing all sources of income.

02

Identify your filing status and any dependent claims that might influence your tax liabilities.

03

Locate Line 20a on Form 1040, reflecting any foreign earned income exclusion and enter the appropriate amount.

04

If applicable, move to Line 20b to document the foreign tax credit, ensuring required forms like Form 1116 are completed prior.

05

Double-check all calculations to ensure accuracy and make any necessary corrections before submission.

Detailed Instructions for Completing the Form

Completing IRS Instruction 1040 Line 20a & 20b begins with understanding how each line affects your overall tax return. Start by entering all qualifying foreign earned income into Line 20a. For Line 20b, identify any eligible foreign taxes paid which can help in claiming a credit that reduces your U.S. tax liability. Accurate bookkeeping and relevant form attachments (like Form 2555 or Form 1116) are essential for compliance.

Show more

Show less

Recent Modifications and Revisions to IRS Instruction 1040 Line 20a & 20b

Recent Modifications and Revisions to IRS Instruction 1040 Line 20a & 20b

This tax year, IRS Instruction 1040 Line 20a & 20b experienced significant changes, including revised thresholds for foreign income exclusions and updated requirements for claiming foreign tax credits. Familiarity with these changes can ensure taxpayers do not miss out on maximizing their refunds.

Essential Insights About IRS Instruction 1040 Line 20a & 20b

Overview of IRS Instruction 1040 Line 20a & 20b

The Purpose Behind IRS Instruction 1040 Line 20a & 20b

Who Needs to Complete This Form?

When Are Exemptions Applicable?

Components of IRS Instruction 1040 Line 20a & 20b

Filing Deadline for IRS Instruction 1040 Line 20a & 20b

Comparing IRS Instruction 1040 Line 20a & 20b with Similar Forms

Types of Transactions Covered by the Form

Required Copies for Submission

Consequences of Failing to Submit IRS Instruction 1040 Line 20a & 20b

Information Required for Completing IRS Instruction 1040 Line 20a & 20b

Other Forms Accompanying IRS Instruction 1040 Line 20a & 20b

Where to Submit IRS Instruction 1040 Line 20a & 20b

Essential Insights About IRS Instruction 1040 Line 20a & 20b

Overview of IRS Instruction 1040 Line 20a & 20b

IRS Instruction 1040 Line 20a pertains to individuals claiming a foreign earned income exclusion, while Line 20b is related to the foreign tax credit. Understanding both lines is essential for taxpayers who have foreign income or have paid taxes to foreign countries.

The Purpose Behind IRS Instruction 1040 Line 20a & 20b

The primary purpose of these lines is to prevent double taxation on income earned abroad. The foreign earned income exclusion allows taxpayers to exclude a set amount of income from U.S. taxation, whereas the foreign tax credit can offset taxes paid to foreign governments against U.S. taxes owed.

Who Needs to Complete This Form?

Taxpayers who have earned income from foreign sources or paid taxes to a foreign government should complete IRS Instruction 1040 Line 20a & 20b. This typically includes expatriates, foreign workers, or U.S. citizens living abroad.

When Are Exemptions Applicable?

Exemptions for Line 20a apply when taxpayers meet specific income thresholds, often based on the Foreign Earned Income Exclusion limits. For example, if a taxpayer earned under $120,000 (2023 threshold), they may be eligible to exclude all or part of their income. Additionally, certain foreign pensions or retirement income may qualify as well.

Components of IRS Instruction 1040 Line 20a & 20b

01

Line 20a: Foreign earned income exclusion amount.

02

Line 20b: Foreign tax credit amount.

Filing Deadline for IRS Instruction 1040 Line 20a & 20b

The deadline for submitting IRS Form 1040, including Lines 20a & 20b, typically falls on April 15, unless extended due to holidays or weekends. Taxpayers abroad may qualify for an automatic extension until June 15, but any owed taxes must still be paid by April 15 to avoid penalties.

Comparing IRS Instruction 1040 Line 20a & 20b with Similar Forms

IRS Form 1116 is often compared to Lines 20a & 20b, as it is used to claim foreign tax credits. Understanding the differences between claiming a tax credit versus an exclusion is crucial for maximizing benefits.

Types of Transactions Covered by the Form

01

Wages or salaries earned by U.S. citizens working overseas.

02

Self-employment income earned in foreign countries.

Required Copies for Submission

Taxpayers must submit one copy of IRS Form 1040, including any attachments for Lines 20a & 20b. Additional documentation, like Form 2555 or 1116, must also be included to substantiate claims.

Consequences of Failing to Submit IRS Instruction 1040 Line 20a & 20b

Penalties for non-compliance can be severe. Common penalties include:

01

Failure to file: Up to 5% of the unpaid tax for each month the tax return is late, capped at 25%.

02

Failure to pay: 0.5% of the unpaid tax for each month, also capped at 25%.

03

Legal consequences may arise for willful neglect or fraudulent claims.

Information Required for Completing IRS Instruction 1040 Line 20a & 20b

01

Your total foreign earned income.

02

Specific foreign taxes paid and documentation proving payment.

Other Forms Accompanying IRS Instruction 1040 Line 20a & 20b

Taxpayers may need to file Form 2555 for foreign earned income exemptions or Form 1116 for foreign tax credits as required by their individual circumstances. Ensuring completeness can facilitate smoother processing by the IRS.

Where to Submit IRS Instruction 1040 Line 20a & 20b

IRS Form 1040, including Lines 20a & 20b, should be mailed to the appropriate IRS address based on the taxpayer’s state of residence. For many individuals, this involves the Kansas City - or Ogden - based address, as specified on the IRS website.

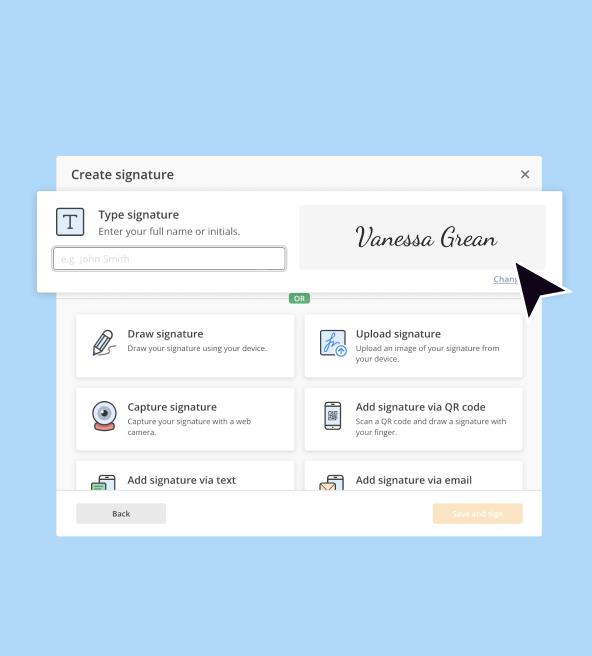

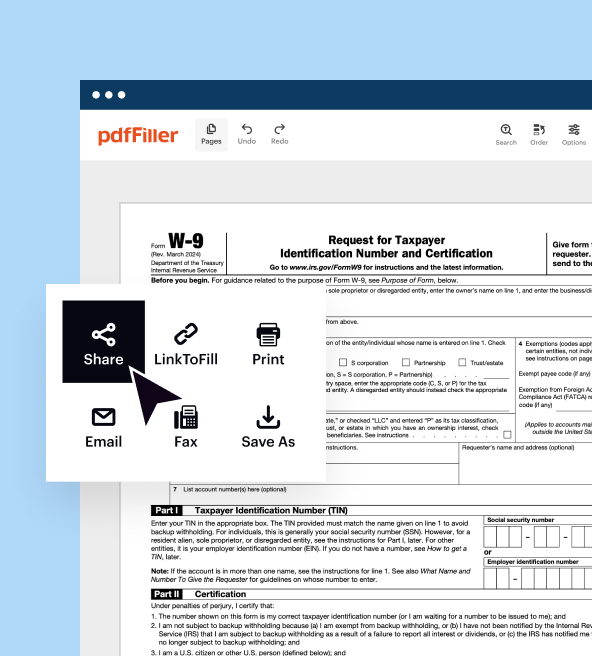

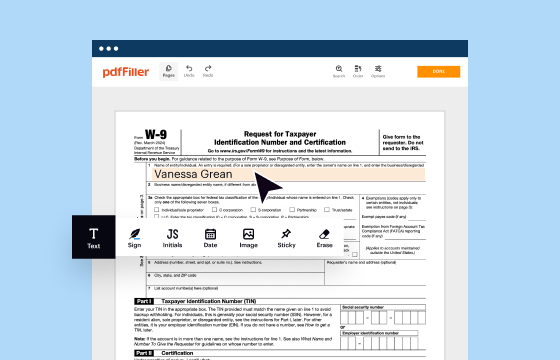

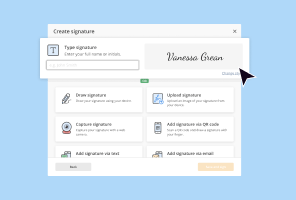

Understanding IRS Instruction 1040 Line 20a & 20b is essential for taxpayers with foreign income. By following the outlined steps and ensuring compliance, you can maximize your deductions and avoid costly penalties. To simplify the filing process, consider utilizing resources like pdfFiller, which allows for easy form completion and submission.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.