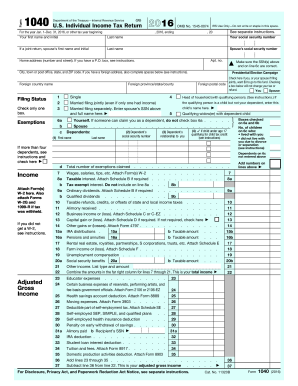

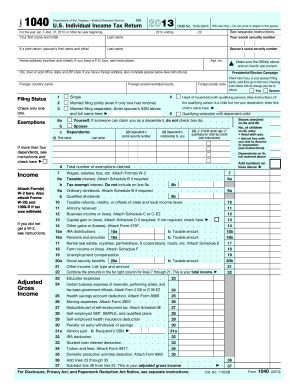

IRS Instruction 1040 Line 20a & 20b 2014-2025 free printable template

Instructions and Help about IRS Instruction 1040 Line 20a 20b

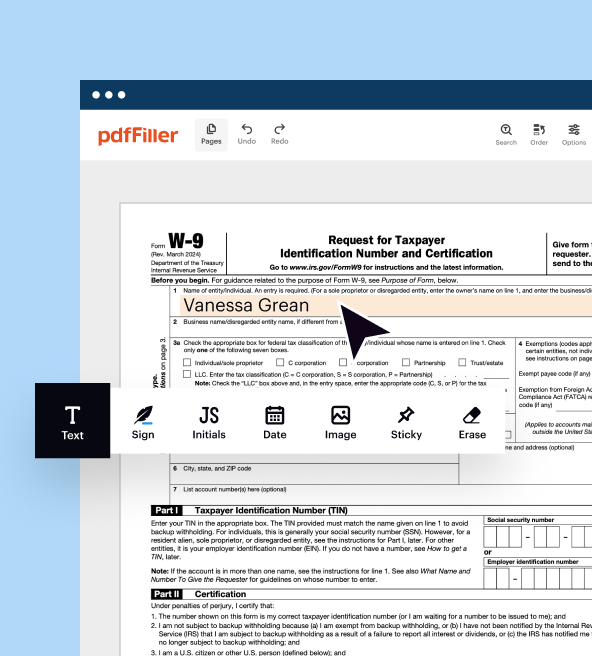

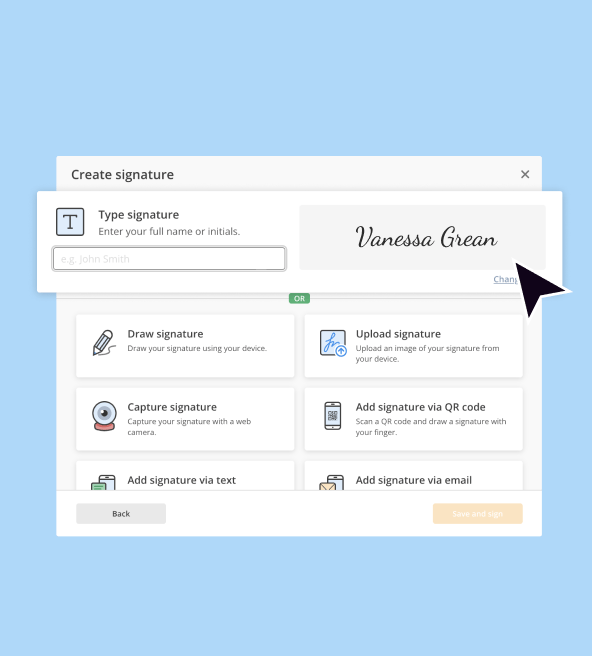

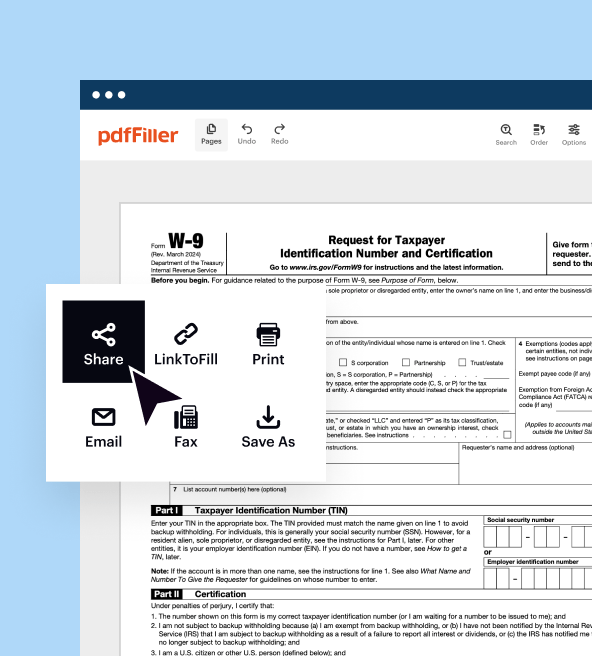

How to edit IRS Instruction 1040 Line 20a 20b

How to fill out IRS Instruction 1040 Line 20a 20b

Latest updates to IRS Instruction 1040 Line 20a 20b

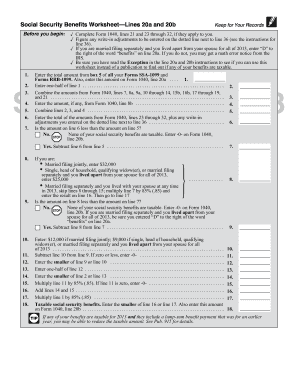

All You Need to Know About IRS Instruction 1040 Line 20a 20b

What is IRS Instruction 1040 Line 20a 20b?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

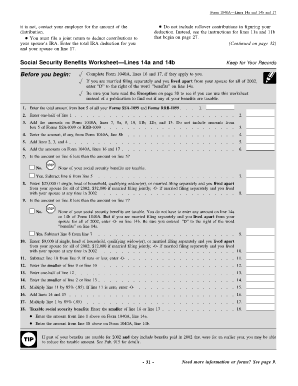

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Instruction 1040 Line 20a 20b

What should I do if I discover an error after submitting the IRS Instruction 1040 Line 20a 20b?

If you find a mistake after submitting your IRS Instruction 1040 Line 20a 20b, you can file an amended return using Form 1040-X. Make sure to clearly indicate the changes you are making and attach any necessary documentation. It’s important to act promptly, as correcting errors can help avoid potential penalties.

How can I verify if my IRS Instruction 1040 Line 20a 20b has been received and processed?

To verify the status of your IRS Instruction 1040 Line 20a 20b, you can use the IRS 'Where's My Refund' tool if you are expecting a refund, or you can call the IRS directly. Keep your personal information ready to confirm your identity when checking the status.

Are there specific privacy measures in place for handling my IRS Instruction 1040 Line 20a 20b?

Yes, the IRS has stringent privacy and data security measures to protect your information filed on the IRS Instruction 1040 Line 20a 20b. Adhere to their guidelines for record retention and ensure your documents are securely stored to maintain your privacy.

What common mistakes should I avoid when submitting the IRS Instruction 1040 Line 20a 20b?

Common errors include incorrect social security numbers, miscalculating tax amounts, and failing to sign your return. Double-check all entries against official documents to avoid these pitfalls and ensure the accuracy of your IRS Instruction 1040 Line 20a 20b.

What should I do if my e-filed IRS Instruction 1040 Line 20a 20b is rejected?

If your e-filed IRS Instruction 1040 Line 20a 20b is rejected, review the error message carefully for specific rejection codes. Address the issues highlighted, correct your return, and resubmit it. Maintain records of both the rejection and the corrected submission for your files.

See what our users say